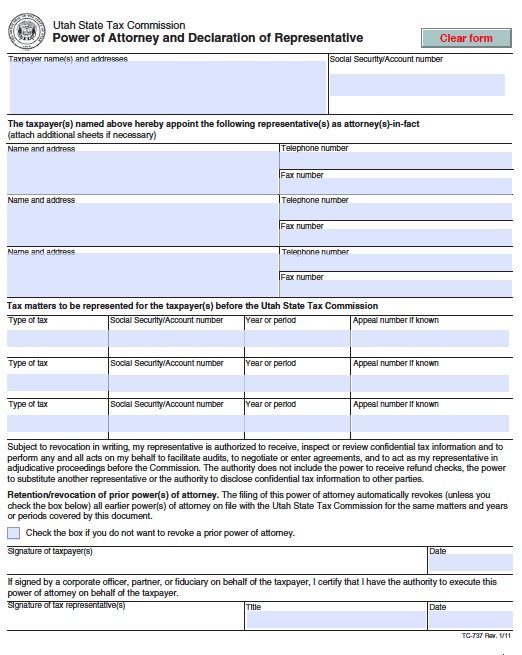

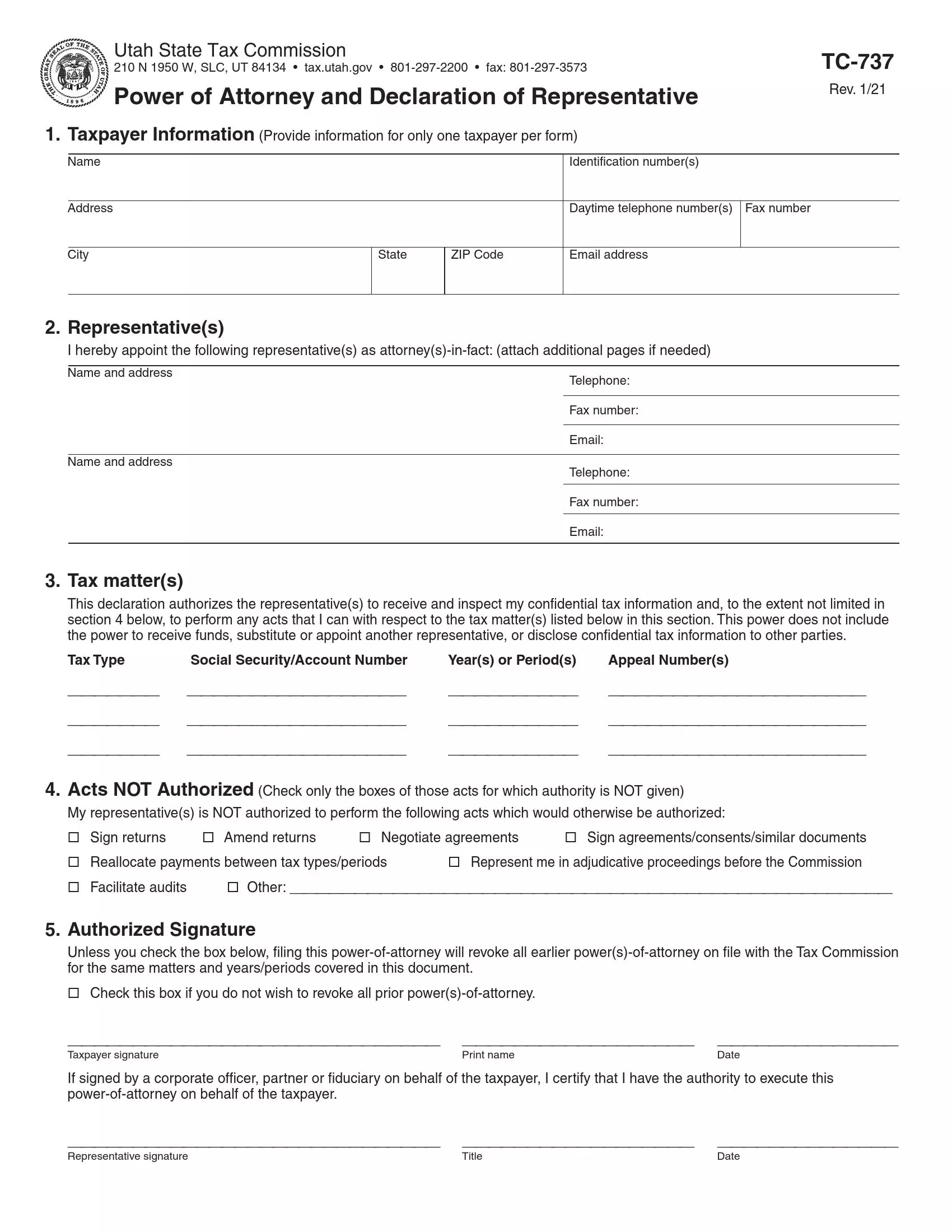

utah tax commission power of attorney

This Power of Attorney and Declaration of Representative will remain in effect until revoked. TC-737 Power of Attorney and Declaration of Representative.

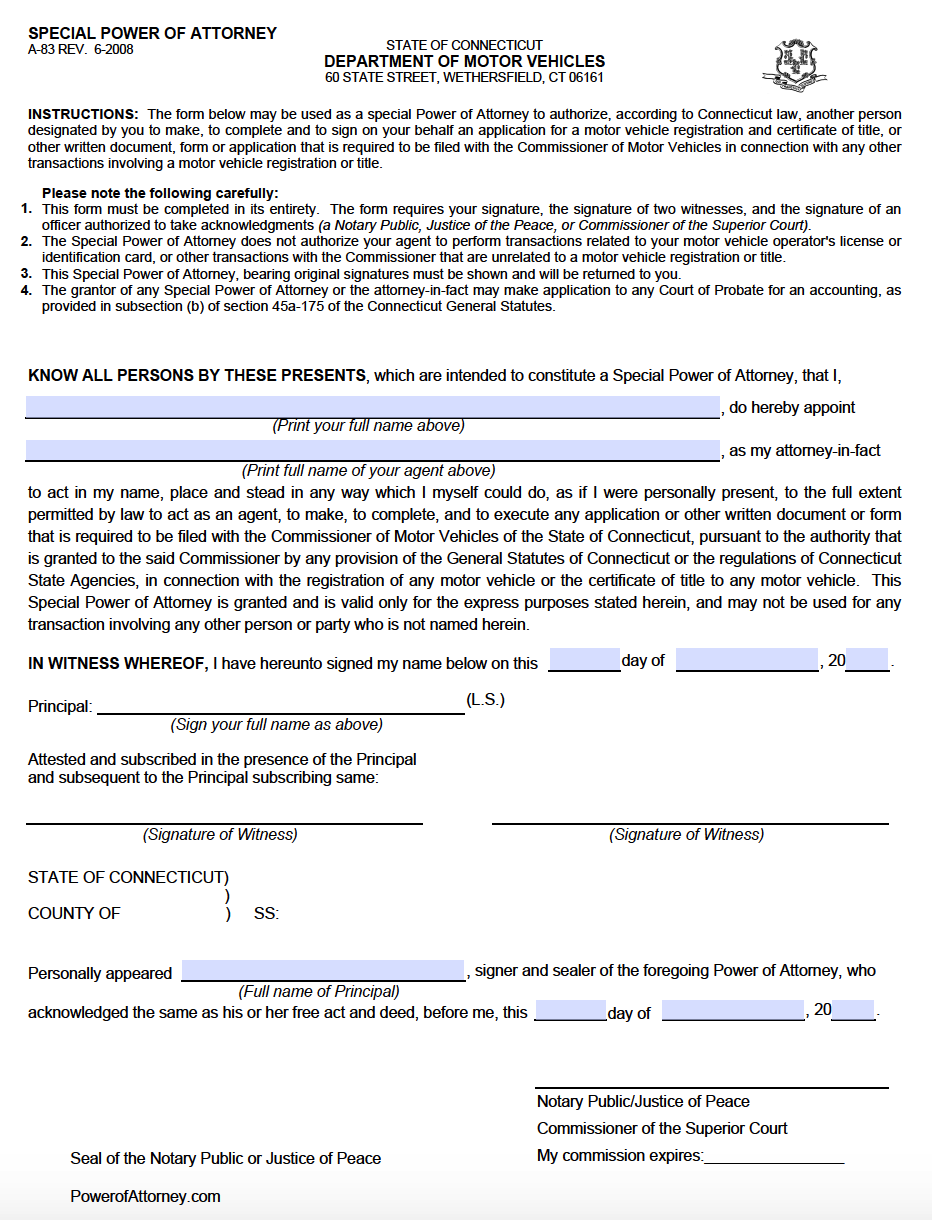

Free Motor Vehicle Power Of Attorney Connecticut Form A 83

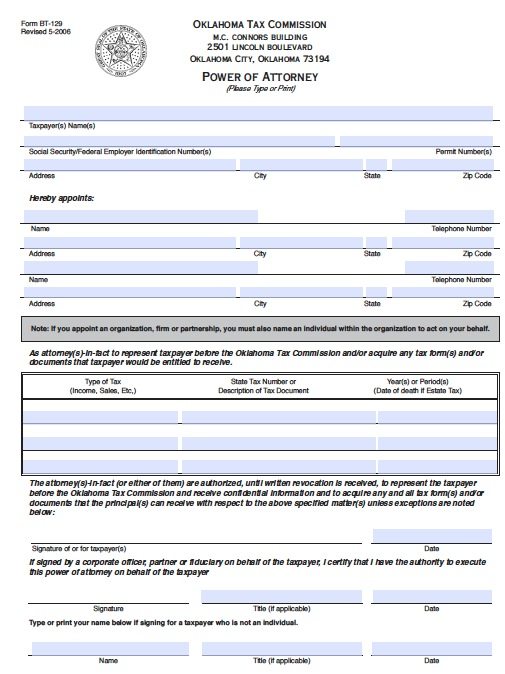

It is recommended to choose either a Certified Public Accountant or Tax Attorney as any omissions or errors will be the liability of the principal.

. Request for Extension of Roll Closing. Utah Power of Attorney Forms Utah power of attorney forms allow for representation granted by a resident for any financial medical tax filing and parental guardianship minor child decisions on their behalf. Also see Document Preparation Guidelines.

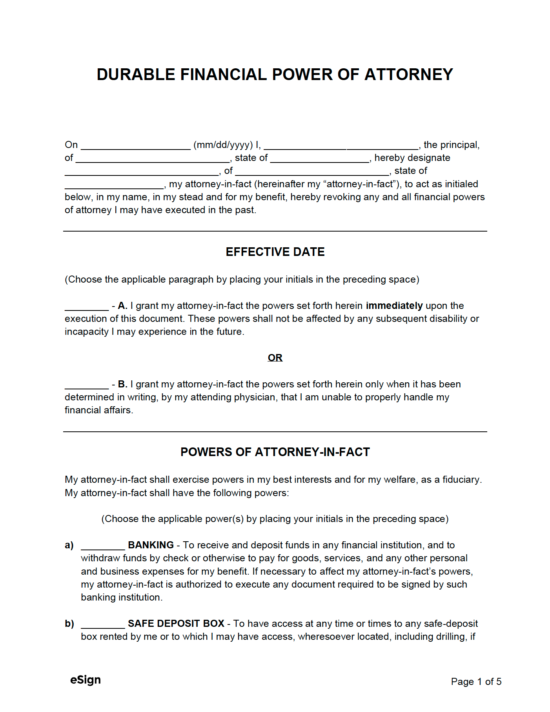

Power of Attorney Utah Tax Estate Planning. IMPORTANT INFORMATION This power of attorney authorizes another person your agent to make decisions concerning your property for you the principal. The authorization automatically ends on the due date for filing your next years tax return without regard to extensions.

A Utah General Financial Power of Attorney Form should be used when designating an agent to represent your interests in financial transactions and other affairs. Object Moved This document may be found here. If you want to change the designees authorization complete and submit TC-737 Power of Attorney and Declaration of Representative.

Power of Attorney and Declaration of Representative. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Ad Download or Email UT Form TC-737 More Fillable Forms Register and Subscribe Now.

What is a Power of Attorney. All in-person requests will be filled within 24 hours. File electronically using Taxpayer Access Point at taputahgov.

The TFS Division represents the divisions of the Utah State Tax Commission in administrative proceedings heard by the Tax Commission and represents the Tax Commission in trial and appellate courts if the Tax Commissions decisions are appealed. 801-297-3573 Power of Attorney and Declaration of Representative. The Tax Commission Appeals Unit will accept all written submissions and forms by facsimile e-mail or mail.

Box 45288 Salt Lake City Utah 84145-0288 DWS-UI Form POA Rev. Download Print - 100 Free. Returning your completed forms.

Offer in Compromise Request. The person granting the power is known as the Principal and the person accepting the designation is known as the Agent. Signatures will be verified.

Legal Guardian or Power of Attorney The representatives of applicants unable to act on their own behalf should submit a signed and notarized power of attorney or other documentation as required by the county with the application. Create a Customized Utah Power of Attorney Form yourself in a few minutes. Your agent will be able to make decisions and act with respect to your property including your money whether or not you are able to act for yourself.

Utah law provides a statutory power of attorney form the Uniform Power of Attorney Act Utah Code 75-9-101 to 403. Create Forms in Minutes. Application for Utah Title Form TC-656.

Ad Create Your How To Power Of Attorney in 5-10 Minutes. Use TC-737 for other tax types. THAT THE UNDERSIGNED a.

Georges Energy Services Department SGESD is to provide safe affordable and reliable energy. If you want to revoke the authorization before it ends submit your request in writing to. Property Tax Abatement Deferral and Exemption Programs for Individuals.

Wed love to help. Utah Code Sections 75-9-101 et seq. 717 Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 wwwtaxutahgov.

A power of attorney POA is a legal document in which one person called the principal gives to another person the agent or sometimes called the attorney in fact authority to act on behalf of the principal. 0916 POWER OF ATTORNEY AUTHORIZATION OF AGENT FORM KNOW ALL MEN BY THESE PRESENTS. The Utah tax power of attorney form otherwise known as form TC-737 allows for the appointment of a tax representative to handle any and all State tax filings with the Utah State Tax Commission.

If you have any questions call us at 877-328-6505. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

The standards present accepted procedures guidelines and forms and are intended to assist county and state officials in the successful administration of the referenced property tax practices. Updated December 28 2021. This website is provided for general guidance only.

If the vehicle is leased make sure the lessor has provided their power of attorney a billing statement and their Utah sales tax number. Taxpayers name Social Security Number Name of personal representative power of attorney Spouses name Social Security Number Address Businesscorporation name EIN City State ZIP Code Physical. Mailed requests take one to two weeks.

You can use Utah form TC-737 Power of Attorney and Declaration of Representative for this purpose. Utah State Tax Commission 210 N 1950 W SLC UT 84134 taxutahgov 801-297-2200 fax. Report a Power Outage or Water Issue The mission statement for the City of St.

It does not contain all motor vehicle laws or rules. Ad Start your free Utah POA form now to appoint an agent to act on your behalf. Taxpayer Services Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134.

To the extent that I may have omitted some power or discretion some tax period some form or some jurisdiction I hereby grant to my attorney-in-fact the power to amend the Internal Revenue Service form power of attorney presently Form 2848 or Form 2848-D in my name. There are many power of attorney forms available on the Internet but they may be too general for your circumstances they may not follow the requirements of Utah law and they may not protect against financial exploitation and abuse. 216 This Power of Attorney and Declaration of Representative is for property taxes only.

Make all requests at. Decide Who Controls Your Legal Affairs in Your Absence. Customize to Fit Your Unique Needs.

The Property Tax Division has prepared Standards of Practice to assist in administering Utah property tax laws. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Skipping tax exemption to which I may be entitled.

UTAH DEPARTMENT OF WORKFORCE SERVICES Unemployment Insurance PO. The Power of Attorney Form will also need to be to be signed by a notary public and have a notary seal at the bottom of the second page before being returned to OnPay. Since your representative can have access to your property and assets as well as make decisions regarding such matters think about who you can trust to.

Standard 3 Tax Relief and Abatement Property Tax Division Standards of Practice Page 4 Limitations. Utah State Tax Commission Property Tax Division propertytaxutahgov Power of Attorney and Declaration of Representative PT-303 Rev.

Utah Granite Mountain Granite Mountain Records Vault Videos Online Vaulting Granite Records

Free Michigan Power Of Attorney Forms Pdf

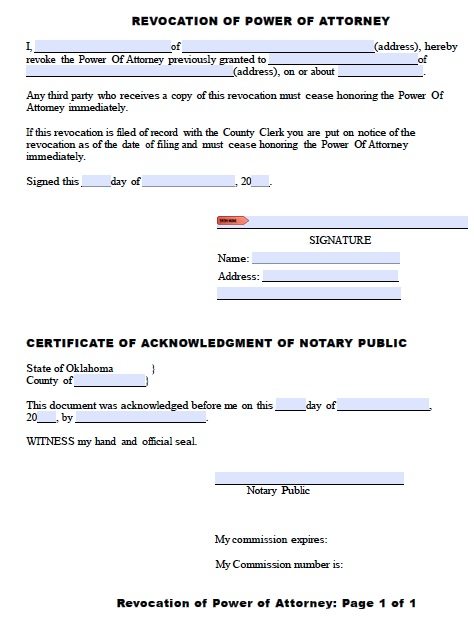

Free Revocation Form For Oklahoma Power Of Attorney Pdf

Free Utah Limited Special Power Of Attorney Form Pdf Word

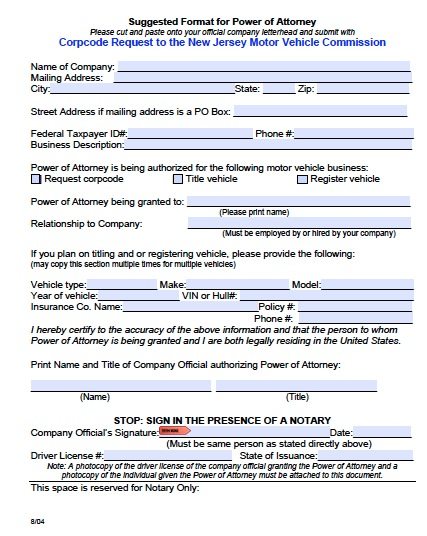

Free Motor Vehicle Power Of Attorney New Jersey Form Pdf

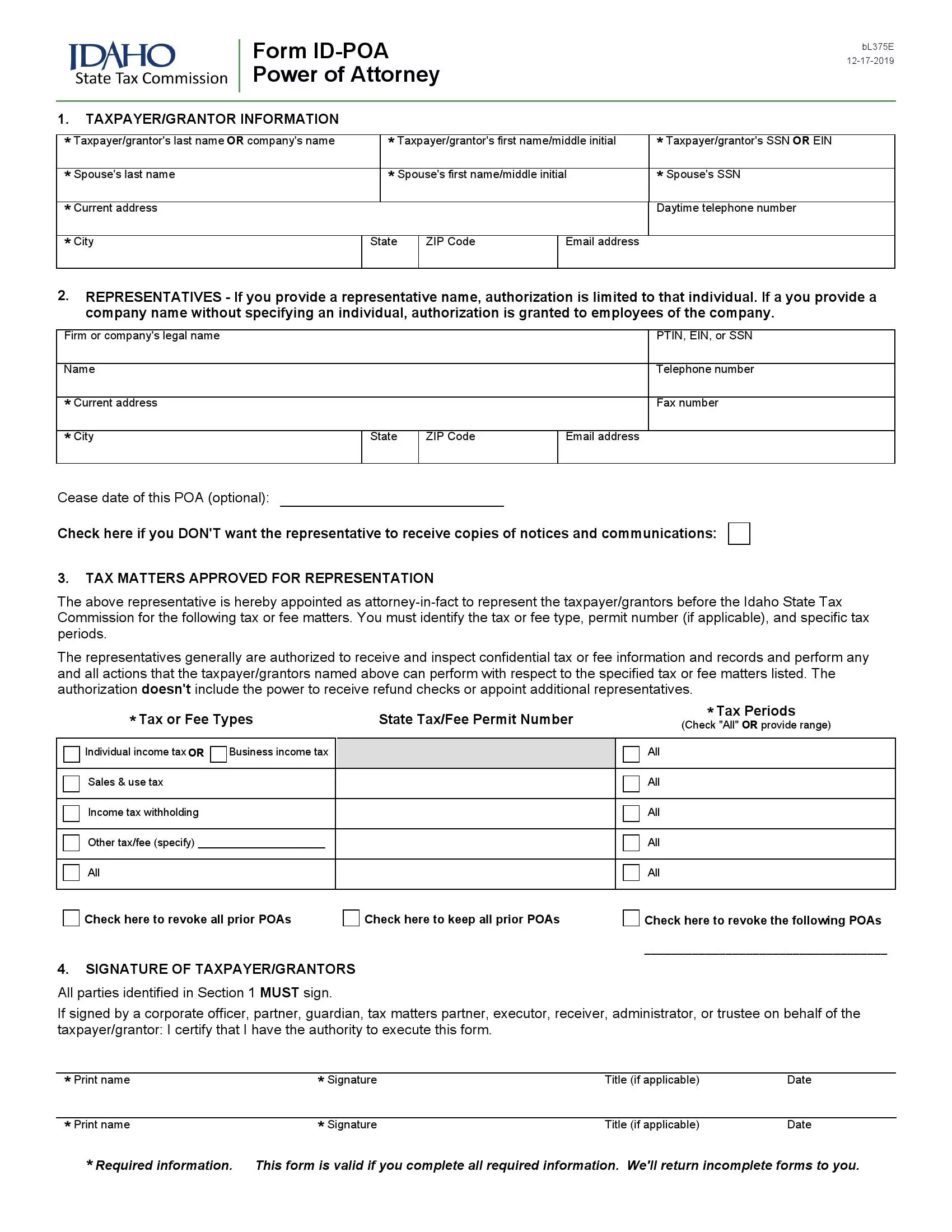

Free Idaho Power Of Attorney Poa Forms Pdf Doc Formspal

Are 144a Securities Private Placements Securities And Exchange Commission Business Lawyer Probate

Utah Secure Power Of Attorney Form Fill Online Printable Fillable Blank Pdffiller

Free Utah Power Of Attorney Forms Pdf Templates

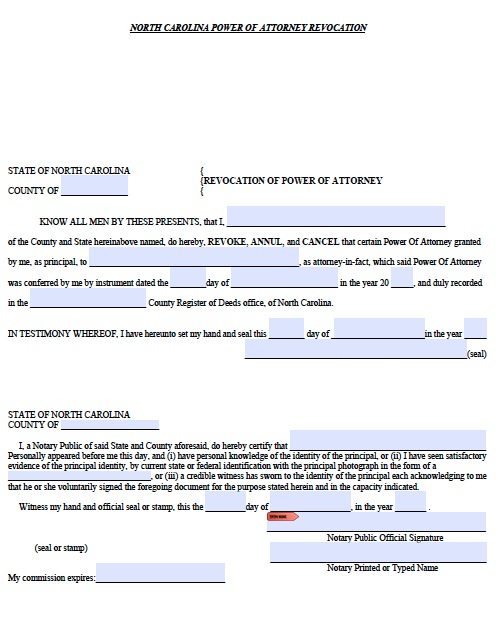

Free Revocation Of Power Of Attorney North Carolina Form Adobe Pdf

Free Utah Power Of Attorney Poa Forms Pdf Doc Formspal

Free New Jersey Tax Power Of Attorney Form Pdf

Sample Limited Power Of Attorney Form Power Of Attorney Form Power Of Attorney Attorneys

Utah Motor Vehicle Power Of Attorney Form Pdfsimpli

Free Power Of Attorney Forms Pdf Word

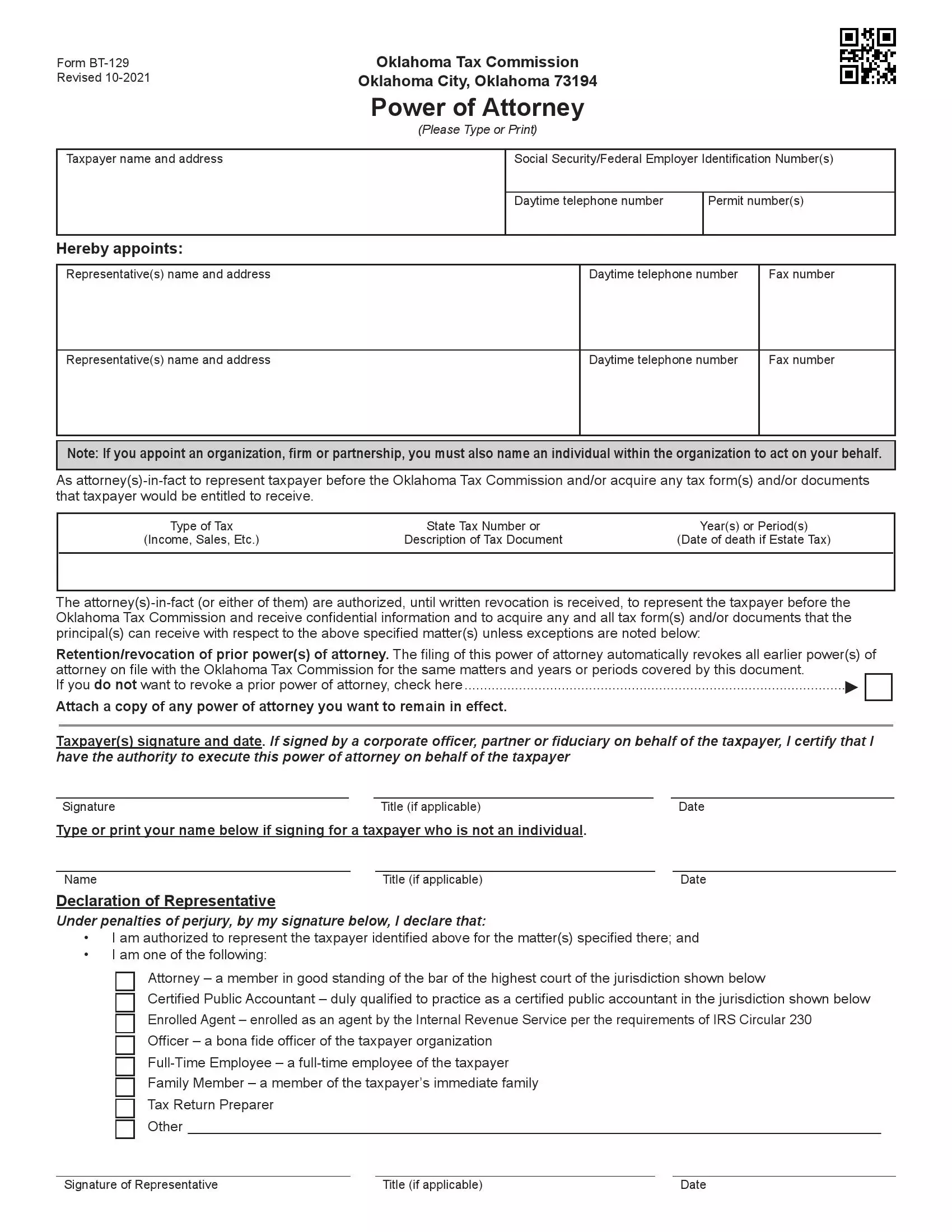

Free Tax Power Of Attorney Oklahoma Form Bt 129 Adobe Pdf

Security Check Required Historical Marker Collin County Organization Help